Building the future, together: The CSF unveils its strategic plan

Montreal, May 13, 2024 - The Chambre de la sécurité financière ("CSF") recently unveiled its 2024-2026 Strategic Plan. The CSF aims to be recognized for its added value, innovations, inclusive approach, and significant contribution to enhancing public confidence in financial services.

"As always, the CFS's new strategic plan is motivated by our desire to ensure optimal protection of the public and to strengthen confidence in the financial ecosystem. It is based on the fundamental values of integrity, professionalism, leadership, collaboration, and caring," said Me Marie Elaine Farley, President and CEO of CSF. "Through this plan," Ms. Farley continued, "we aspire to become a unifying body in our industry, an engaged actor contributing to the modernization of the regulatory system. We also aim to amplify our communications to demonstrate the added value of the CSF both to the public and to our sector."

"Our three strategic directions stem from a broad and inclusive consultation process. The planning exercise enabled us to gather the views and concerns of all our stakeholders and the ecosystem regarding our services and our mission of protecting the public. Despite the challenges presented by our rapidly evolving environment, this exercise has allowed us to identify opportunities and position ourselves to address these issues, on the one hand, and to remain committed to continuing to act as a unifying regulatory body within Quebec's financial community," she added.

The CSF intends to continue its collaborations with its members, compliance officers, professional development specialists and other stakeholders to consolidate its presence and active role in the distribution of financial products and services.

Contributing to the financial sector

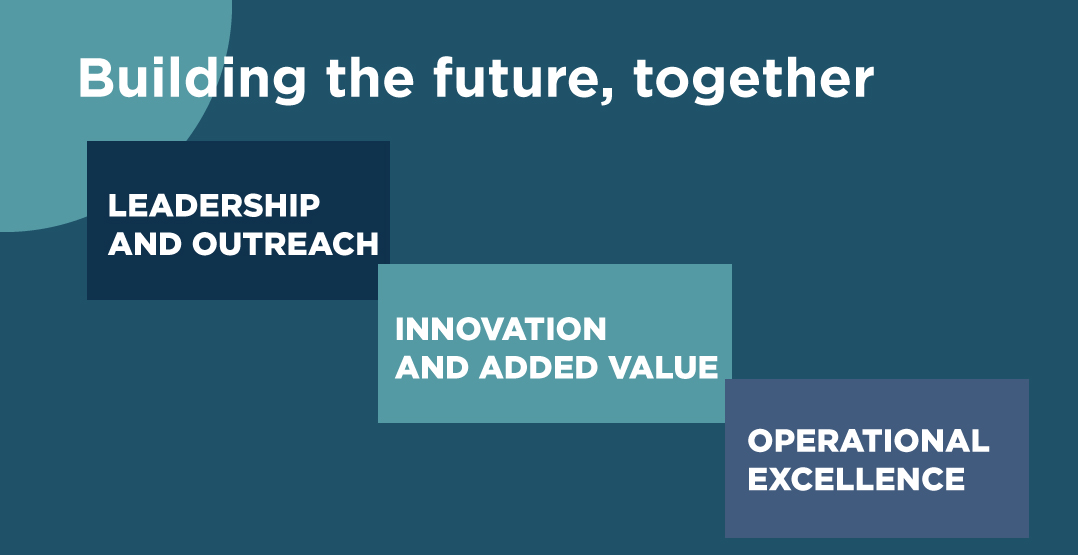

To guide the implementation of its strategic plan, the CSF has established three major orientations for its projects and initiatives:

- Leadership and outreach - The CSF aims to unify the ecosystem and contribute to the modernization of the regulatory system. To achieve this, it is important to demonstrate CSF's added value, within its environment and to the public, and to increase its communications.

- Innovation and added value - The CSF aims to better meet its clients' evolving expectations by being an innovative self-regulatory body that remains actively aware of the public's habits and expectations, and that supports its professional members in the face of societal changes.

Operational excellence - By focusing on impeccable governance and equipping itself with cutting-edge technological tools, the CSF is committed to optimizing its outcomes (IT, data, engaged employees, etc.) and focusing its actions on the customer experience.

Solid foundations

"This strategic plan is a crucial step for the CSF. It reflects our commitment to protecting the public and maintaining its confidence in the integrity of financial professionals. We are determined to implement the necessary initiatives to achieve our objectives and to work with our stakeholders to do so," concluded Me Farley.

Ensuring a good understanding of key sectoral issues

The CSF is committed to collaborating and increasing positive and beneficial synergies for its stakeholders and providing a clear and insightful analysis of its environment, whether through its regional tours with members or consultations with industry players. The CSF is well aware of the issues that may influence its interventions.

The issues, which are likely to evolve based on observed realities within the financial sector, are as follows:

- It is necessary to explore new working methods and ways to reach clients, given the inherent obstacles of digital transition and the protection of personal and corporate data. A repositioning of the advisor's role is required, given the risk of "devaluation" of their role.

- One must deal with the macroeconomic situation, which is marked by high interest rates, increased cost of living, household debt, and the debate on the integration of ESG criteria, all major and concomitant destabilizing factors.

- There is a consolidation of companies, motivated by the expansion of their product range and geographical presence, leading to economies of scale and increased investment capacity. The financial sector's polarization is also concerning, with a decrease in the number of specialized players and an increase in challenges related to the retention and remuneration of smaller players. The distinction between products and services is fading. The role of the multidisciplinary advisor is gaining importance, including for financial planners.

- The increasing regulatory burden is seen as a risk for large financial institutions, dealers, and firms. Seeking harmonization between the requirements of different regulatory bodies is necessary to avoid role confusion.

- There is a shortage of labor and a lack of succession in the sector with the departure of baby boomers and intergenerational wealth transfer. Moreover, it is increasingly difficult to find adequate successors, leading to the sale of many firms. The distribution network therefore lacks advisors. It becomes necessary to facilitate entry into the profession, despite a limited pool of candidates and a lack of recognition for the profession.