Customer segmentation in the succession process

Let’s continue our reflection on succession planning for financial services advisors. In previous articles, we talked about having a strategy, mapping a process, and compliance. Let’s now look at the most important part of your practice: your clients.

For many years, you’ve advised a lot of individuals, families and businesses. Part of your knowledge and understanding of these clients can be found in your file notes and your CRM. But there’s an intangible part that you cannot document easily. It’s this goodwill that you should try to protect using segmentation so you can better serve your clients even when planning your retirement.

You’re sure to be familiar with the concept of segmentation: separating a market into homogeneous subgroups (segments) based on age, sex, income, lifestyle, or other factors, which enables companies to tailor their products to consumers’ specific needs. In our sector, we often see segmentation into three groups, sometimes more. This kind of segmentation is very useful to organize our schedules and better meet clients’ expectations.

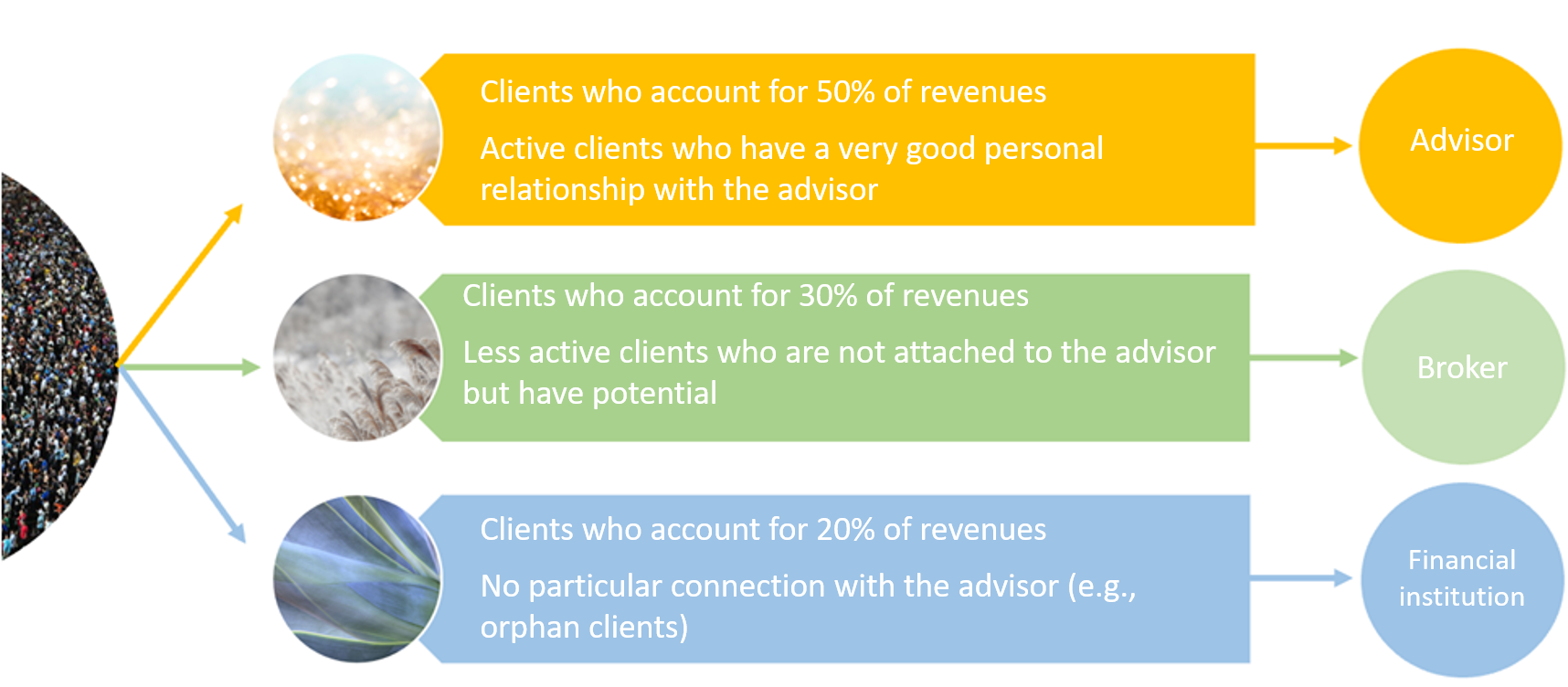

I propose using the principle of segmentation when planning your succession, as illustrated in the diagram below:

segmentation, especially the factors for the different groups, is just one illustration of segmentation in a retirement process. For your best clients, you could focus your efforts on finding an advisor who is like you. For those who bring a moderate amount of business, ask your broker if he or she could recommend a young advisor who might be interested and would have the time to develop these clients. And why not tell the clients in the last group, who account for 20% of your income, that you plan to retire and ask them whether they’d prefer to be referred to a young advisor or their primary financial institution?

A succession with multiple buyers is not as simple as one with a single successor for your entire practice. But it’s certainly the best option for your clients, especially if you have large blocks of business.

Remember that whatever you do, even if your successors are outstanding, the client’s loyalty was to you, in particular.

The next article in this series will address factors that can influence your business’s financial value.

Read also

PRESS RELEASE

PRESS RELEASE