Financial advisor of the future: multidisciplinary skills

The financial products and services distribution sector is undergoing significant evolution, mainly due to the technological advancements of recent decades (accelerated by the pandemic), the plethora of new products in the market, the behaviors of young investors, and the more holistic expectations of consumers. How does this impact the work of advisors? What skills must they master to cope with the pace of change and continue to provide excellent service to their clients?

These questions spurred the Chambre de la sécurité financière (CSF) to renew its strategy for continuous education and professional development and define the scope of its offerings, all while continuing to fulfill its important mission of public protection. "We want to be able to equip professionals so that they can provide a service that better meets the expectations of their clients, who themselves are hoping for something increasingly holistic," says Daniel Richard, Vice-President of Community Relations at the CSF.

To guide its research into the skills of tomorrow's financial services advisor, the CSF enlisted the services of the organizational psychology firm Humance and embarked on a significant process involving both members and key players in the industry. The goal was to identify specific behaviors that have the greatest impact on achieving advisors' top priorities while considering the world in which they operate.

Relevant data

First, it was necessary to examine how the profession is evolving. This is what the CSF did, in collaboration with its partner Humance, by conducting an in-depth literature review and studying the results of previous work on professional development carried out by the Chambre in 2017-2018, as well as data that the firm itself collected from other organizations in the financial products and services sector.

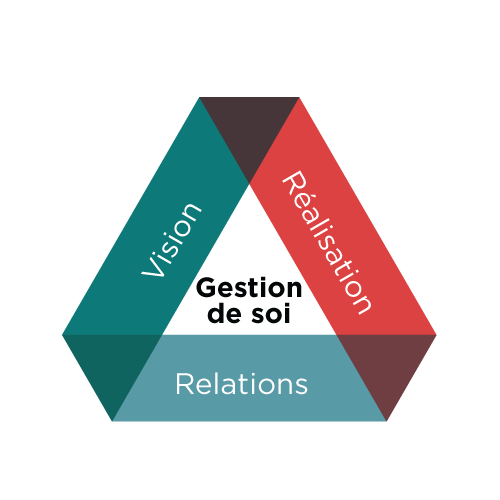

To successfully conduct its consultations and to enable the use of a common language, the Chambre chose to use Humance's skills framework, which is also used in several organizations in the financial sector. With 48 skills divided into four major categories - vision, execution capacity, relational skills, and self-management - this allowed them to consider all these skills, but with the goal of identifying the most universal multidisciplinary skills, those that are essential for any professional, whether specialized in scholarship plans, life insurance, or collective savings.

Multidisciplinary skills

1. Client-centric approach*

Prioritizes customer satisfaction, actively engages with customer needs, and seeks to provide a positive customer experience.

2. Continuous development

Seeks opportunities to stay updated, acquire new knowledge and skills, and engage in experiences that contribute to professional development.

3. Business development

Keeps an eye on business perspectives and creates the conditions to realize them and generate revenue.

4. Synthesis ability in complexity*

In a context involving diverse scenarios and complex solutions, extracts the essence of a situation, issue, and its solutions.

5. Impactful communication*

Presents ideas clearly, captures the interest of people involved, and persuades others of the validity of their ideas.

6. Rigor

Adopts an approach in line with professional standards and organizational practices, paying attention to details in work execution.

7. Agile prioritization

Adapts priorities continuously, remaining attuned to changes in the environment influencing the urgency and importance levels of each situation.

* Skills deemed a priority by members during the AGA 2023

Fascinating workshops

The CSF organized workshops attended by compliance, training, and distribution executives. Animated discussions took place, particularly about the importance of collaboration. "Participants working in larger groups considered this skill a priority," notes Julie Carignan, organizational psychologist and associate at Humance, while others wondered if it was universal, since some manage to stand out by working independently." For his part, Daniel Richard believes that, to serve clients well, the advisor of tomorrow will need to collaborate with peers as well as other professional allies offering complementary services.

The exercise was sometimes challenging. "Since we were aiming to prioritize skills that were common to all disciplines regulated by the CSF, there were some that we couldn't retain even though several participants found them essential," says Julie Carignan. Still, seven universal skills emerged from this, including client-centric approach, business development, continuous development, synthesis ability in complexity, impactful communication, rigor, and agile prioritization.

Among them, "client-centric approach" - prioritizing customer needs, showing empathy, and providing a positive experience - seems to be particularly important. "Technical skills remain important, but as artificial intelligence makes significant advancements, it's interesting to see these relational skills emerge that allow humans to stay ahead of machines," Julie Carignan points out.

Insightful findings

Specialized literature, as well as industry clientele, suggests a significant shift in the profession, requiring a greater focus on customers rather than products. Genuine consideration for others and the ability to adapt to a wide range of people are ingredients supporting a strong customer orientation.

Beyond expertise, which remains important, relational skills such as listening, impactful expression, and influence are indispensable for success in the profession. Business development skills, including maintaining a strong network of contacts and creating revenue-generating opportunities, are also crucial in guiding relational skills toward achieving business objectives.

Mastery of numerous complex solutions and rigor in work execution continue to be important demands in the profession. Nevertheless, given the rapid and constant evolution of product and service offerings, greater emphasis is placed on the ability to learn and the commitment to continuous development, rather than mastering a specific list of products.

In a field where decoding a variety of data is crucial for guiding customer-oriented strategies and solutions, it's clear that visionary thinking, strategy development, and analytical depth skills are emerging.

Upcoming implications

According to Daniel Richard, these results will influence the education of financial services advisors as well as the recruitment of new professionals. With new financial products continuing to multiply, it's more important than ever that professionals possess the skills determined to be priorities or turn to continuous education to acquire them. It's also important to consider that younger generations don't learn in the same way as previous generations.

This information will be particularly useful next fall when the CSF works on designing its professional development strategy, defining the scope of its offerings, and ensuring that its technological infrastructure can effectively support its ambitions. As only through well-adapted training to current and future challenges can the financial services advisor of tomorrow continue to fulfill their significant responsibility to act in the best interest of their clients and meet consumer expectations.

Read also

PRESS RELEASE

PRESS RELEASE

MAIN FEATURE

Taking up residence outside the country for varying periods of time is a project that attracts many people. In Canada, some 900,000 snowbirds spend several months in the southern United States every year. What's more, the choice of destinations and the reasons for doing so, whether personal or professional, have diversified. This dossier is packed with tips and best practices to guide advisors and their clients in their preparations. Financial challenges and tax obligations are among the topics covered.